Introduction to Amarkets Minimum Deposit

When starting your trading journey, one of the first things to consider is the initial investment required. Amarkets, a well-established online broker, offers various account types with different Amarkets minimum deposit requirements. This article will delve into the details of these requirements, helping you understand how much you need to start trading with Amarkets and what you can expect from each account type.

Understanding the Amarkets minimum deposit is crucial for new traders who want to enter the financial markets without committing large sums of money upfront. It's also important for experienced traders who are considering switching to Amarkets and want to know how much they need to transfer to open an account.

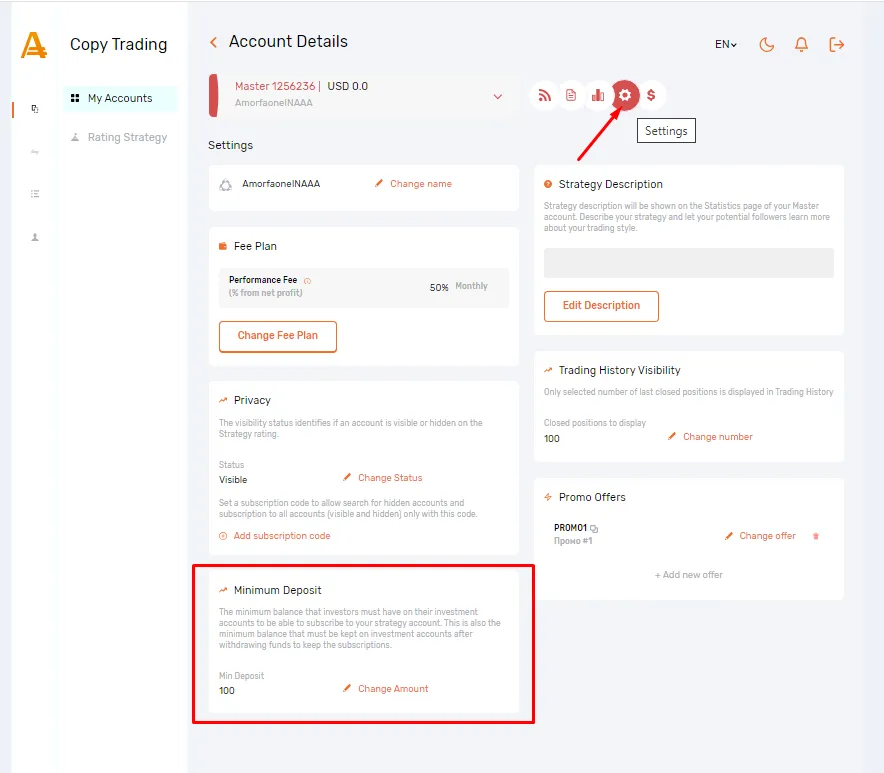

Overview of Amarkets Account Types and Minimum Deposits

Amarkets offers several account types, each tailored to different trading styles and experience levels. Here's a quick overview of the account types and their respective Amarkets minimum deposit requirements:

| Account Type | Minimum Deposit |

|---|---|

| Standard Account | $100 or equivalent |

| Fixed Account | $100 or equivalent |

| ECN Account | $200 or equivalent |

| Crypto Account | 0.001 BTC or equivalent |

As you can see, the Amarkets minimum deposit starts at $100 for most account types, making it accessible for many traders. Let's explore each account type in more detail.

Standard Account Minimum Deposit

The Standard Account is Amarkets' most popular option, suitable for both beginners and experienced traders. Here are the key features:

- Amarkets minimum deposit: $100 or equivalent

- Floating spreads from 1.3 pips

- Leverage up to 1:3000

- No commission on trades

- Access to 40+ currency pairs, metals, indices, and more

This account type offers a good balance between accessibility and trading conditions. The relatively low minimum deposit makes it easy for new traders to get started, while the high leverage and floating spreads can be attractive for more experienced traders.

Fixed Account Minimum Deposit

The Fixed Account is designed for traders who prefer predictable trading costs. Its features include:

- Amarkets minimum deposit: $100 or equivalent

- Fixed spreads from 3 pips

- Leverage up to 1:3000

- No commission on trades

- Instant execution

This account type can be particularly useful for traders who use strategies that require knowing exact costs in advance, such as scalping or algorithmic trading. The minimum deposit requirement is the same as the Standard Account, making it equally accessible.

ECN Account Minimum Deposit

The ECN (Electronic Communication Network) Account is geared towards more experienced traders who prioritize tight spreads and fast execution. Its features include:

- Amarkets minimum deposit: $200 or equivalent

- Floating spreads from 0 pips

- Leverage up to 1:3000

- Commission of $5 per lot (round turn)

- Direct access to liquidity providers

While the Amarkets minimum deposit for this account is higher, it offers the most competitive trading conditions. The higher initial investment reflects the advanced nature of this account type.

Crypto Account Minimum Deposit

The Crypto Account is specifically designed for cryptocurrency trading. Its main features are:

- Amarkets minimum deposit: 0.001 BTC or equivalent

- Floating spreads

- Leverage up to 1:5

- No commission on trades

- Access to major cryptocurrencies

This account type allows traders to focus on cryptocurrency trading without the need to convert to fiat currencies. The minimum deposit is set in Bitcoin, reflecting the crypto-centric nature of this account.

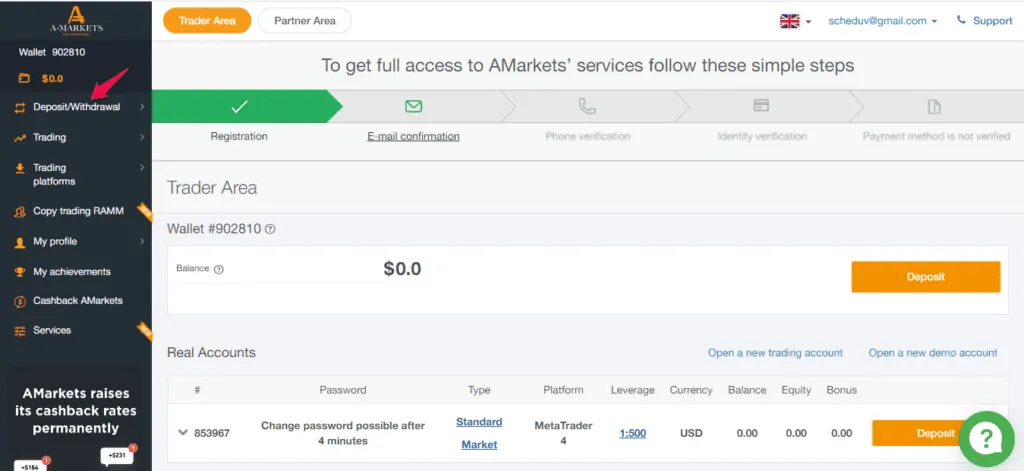

Deposit Methods and Processing Times

Amarkets offers various methods to fund your account and meet the Amarkets minimum deposit requirement. Here's an overview of the available deposit methods and their processing times:

| Deposit Method | Processing Time | Minimum Amount |

|---|---|---|

| Credit/Debit Cards | Instant | $10 |

| Bank Wire Transfer | 3-5 business days | $100 |

| E-wallets (Skrill, Neteller) | Instant | $10 |

| Cryptocurrencies | 1-3 confirmations | Varies by currency |

It's important to note that while some deposit methods have lower minimums than the Amarkets minimum deposit for account opening, you'll need to ensure your total deposit meets the requirement for your chosen account type.

Deposit NowFactors to Consider When Choosing Your Initial Deposit

While the Amarkets minimum deposit sets the lower limit for opening an account, you might want to consider depositing more than the minimum. Here are some factors to keep in mind:

- Trading style: Day traders or scalpers might need a larger buffer to handle multiple trades.

- Risk management: A larger deposit allows for better risk management, as you can risk a smaller percentage of your account on each trade.

- Instrument choice: Some instruments, like stocks or indices, might require larger position sizes and thus more capital.

- Leverage use: While high leverage is available, using it responsibly often requires a larger capital base.

- Long-term goals: Consider your trading goals and how much capital you'll need to realistically achieve them.

Remember, it's always advisable to start with an amount you can afford to lose and to practice proper risk management techniques.

Demo Account Option

Before committing to the Amarkets minimum deposit, you have the option to open a demo account. This allows you to practice trading with virtual funds in real market conditions. Benefits of using a demo account include:

- Familiarizing yourself with the trading platform

- Testing different trading strategies without risk

- Understanding how different account types work

- Practicing risk management techniques

The demo account is free to open and use, providing a risk-free way to experience Amarkets' trading conditions before making a real deposit.

Tips for New Traders Starting with Minimum Deposit

If you're new to trading and starting with the Amarkets minimum deposit, here are some tips to help you make the most of your initial investment:

- Start small: Begin with micro lots to manage risk with a small account balance.

- Use proper risk management: Never risk more than 1-2% of your account on a single trade.

- Take advantage of educational resources: Amarkets offers various educational materials to help you improve your trading skills.

- Practice on a demo account first: Get comfortable with the platform and your strategies before trading with real money.

- Be patient: Don't expect to double your account overnight. Focus on consistent, small gains.

Remember, successful trading is about preserving capital and making consistent profits over time, not about making large gains quickly.

Comparison with Other Brokers

To give you a better perspective, let's compare the Amarkets minimum deposit requirements with those of other popular brokers:

| Broker | Minimum Deposit |

|---|---|

| Amarkets | $100 |

| Broker B | $200 |

| Broker C | $50 |

| Broker D | $250 |

As you can see, the Amarkets minimum deposit is competitive within the industry, offering a good balance between accessibility and account features.

Open AccountConclusion

The Amarkets minimum deposit requirement of $100 for most account types provides a relatively low barrier to entry for traders looking to start their journey in the financial markets. This accessible entry point, combined with the variety of account types available, makes Amarkets an attractive option for both new and experienced traders.

When considering the Amarkets minimum deposit, it's important to choose an account type that aligns with your trading style and goals. While it's possible to start with the minimum amount, consider your long-term trading objectives and whether a larger initial deposit might be beneficial for your trading strategy.

Remember that successful trading is not just about the initial deposit, but about continuous learning, disciplined risk management, and consistent application of a well-thought-out trading strategy. Amarkets provides the tools and resources to support your trading journey, regardless of your starting capital.

FAQ

Can I open an account with less than the Amarkets minimum deposit?

Generally, you need to meet the minimum deposit requirement to open a live trading account with Amarkets. However, you can open a demo account for free to practice trading and familiarize yourself with the platform before committing real funds.

How long does it take for my deposit to be credited to my Amarkets account?

The processing time for deposits varies depending on the method used. Credit/debit card deposits and e-wallet transfers are usually instant. Bank wire transfers can take 3-5 business days. Cryptocurrency deposits typically require 1-3 blockchain confirmations.

Can I withdraw my Amarkets minimum deposit immediately after opening an account?

While you can request a withdrawal at any time, Amarkets may have certain requirements before processing a withdrawal, such as account verification or minimum trading volume. It's best to check the current withdrawal policy or contact customer support for specific details about your account.