Introduction to Amarkets Account Types

Amarkets, a well-established online broker, offers a range of account types to cater to different trading styles and preferences. Understanding the various Amarkets account types is crucial for traders to choose the one that best suits their needs. This article will provide a comprehensive overview of the account options available at Amarkets, their features, and how they compare to each other.

Whether you're a beginner just starting your trading journey or an experienced trader looking for advanced features, Amarkets has designed its account types to accommodate a wide spectrum of traders. Let's delve into the details of each account type and explore what they have to offer.

Overview of Amarkets Account Types

Amarkets offers four main types of trading accounts, each with its own set of features and benefits. These account types are:

- Standard Account

- Fixed Account

- ECN Account

- Crypto Account

Each of these Amarkets account types is tailored to meet specific trading needs and preferences. From beginners looking for straightforward trading conditions to advanced traders seeking tight spreads and fast execution, there's an account type for everyone.

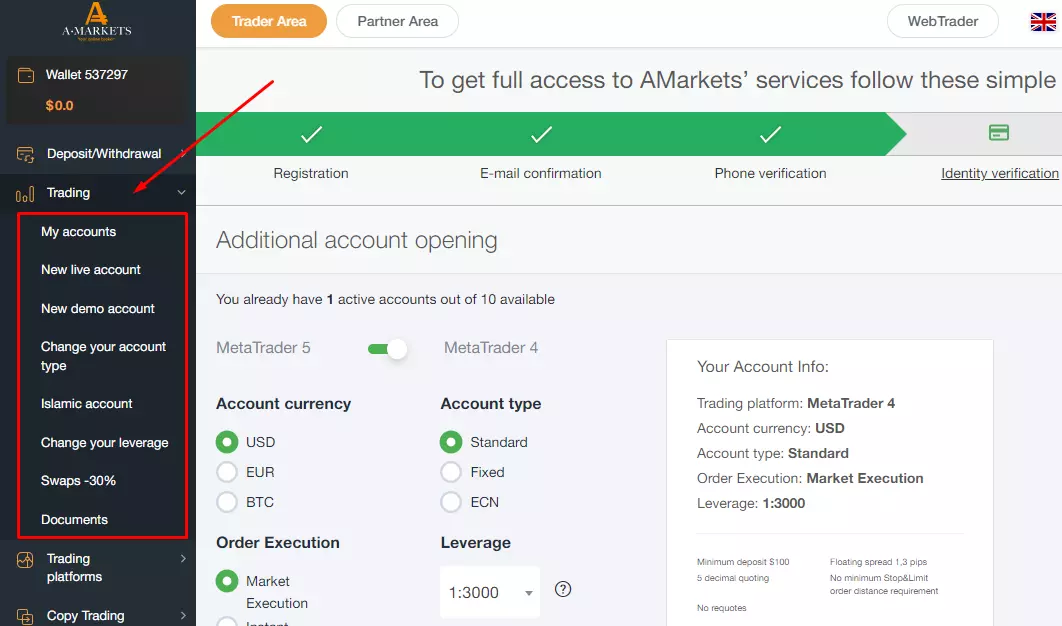

Standard Account

The Standard Account is Amarkets' most popular account type, suitable for both beginners and experienced traders. Here are its key features:

- Minimum deposit: $100

- Floating spreads starting from 1.3 pips

- Leverage up to 1:3000

- No commission on trades

- Market execution

- Available in USD and EUR

This account type offers a good balance between accessibility and trading conditions. The relatively low minimum deposit makes it easy for new traders to get started, while the high leverage and floating spreads can be attractive for more experienced traders.

Fixed Account

The Fixed Account is designed for traders who prefer predictable trading costs. Its main features include:

- Minimum deposit: $100

- Fixed spreads from 3 pips

- Leverage up to 1:3000

- No commission on trades

- Instant execution

- Available in USD and EUR

This account type can be particularly useful for traders who use strategies that require knowing exact costs in advance, such as scalping or algorithmic trading.

ECN Account

The ECN (Electronic Communication Network) Account is geared towards more experienced traders who prioritize tight spreads and fast execution. Its features include:

- Minimum deposit: $200

- Floating spreads starting from 0 pips

- Leverage up to 1:3000

- Commission of $5 per lot (round turn)

- Market execution

- Available in USD and EUR

This account type offers the most competitive trading conditions among the Amarkets account types, but it also requires a higher minimum deposit and charges a commission per trade.

Crypto Account

The Crypto Account is specifically designed for cryptocurrency trading. Its main features are:

- Minimum deposit: 0.001 BTC

- Floating spreads

- Leverage up to 1:5

- No commission on trades

- Market execution

- Account currency: BTC

This account type allows traders to focus on cryptocurrency trading without the need to convert to fiat currencies.

Comparison of Amarkets Account Types

To help you better understand the differences between the Amarkets account types, here's a comparison table:

| Feature | Standard | Fixed | ECN | Crypto |

|---|---|---|---|---|

| Minimum Deposit | $100 | $100 | $200 | 0.001 BTC |

| Spreads | Floating from 1.3 pips | Fixed from 3 pips | Floating from 0 pips | Floating |

| Commission | No | No | $5 per lot | No |

| Leverage | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 | Up to 1:5 |

| Execution Type | Market | Instant | Market | Market |

This comparison highlights the key differences between the Amarkets account types, allowing traders to choose the one that best fits their trading style and goals.

Open AccountChoosing the Right Account Type

Selecting the most suitable among the Amarkets account types depends on several factors. Consider the following when making your choice:

- Trading experience: Beginners might prefer the Standard or Fixed accounts, while more experienced traders could benefit from the ECN account.

- Trading style: Day traders and scalpers might prefer the ECN account for its tight spreads, while swing traders might be comfortable with the Standard account.

- Available capital: The minimum deposit requirements differ between account types.

- Preferred assets: If you're primarily interested in cryptocurrencies, the Crypto account might be the best choice.

- Risk tolerance: Higher leverage options come with increased risk, so consider your risk management strategy when choosing an account type.

Remember, you can always start with one account type and switch to another if you find it doesn't meet your needs.

Additional Features Across Account Types

Regardless of which of the Amarkets account types you choose, all accounts come with certain standard features:

- Access to MetaTrader 4 and MetaTrader 5 platforms

- Mobile trading apps for iOS and Android

- Free demo account for practice

- Access to educational resources and market analysis

- 24/5 customer support

These features ensure that all traders, regardless of their account type, have access to the tools and support they need to trade effectively.

Islamic (Swap-Free) Account Option

In addition to the standard Amarkets account types, the broker also offers an Islamic or Swap-Free account option. This account type is designed for traders who follow Islamic financial principles and cannot pay or receive interest (swap) on overnight positions.

The Islamic account option is available for the Standard, Fixed, and ECN account types. It maintains all the features of the regular accounts but does not involve swap charges or credits for holding positions overnight.

| Feature | Islamic Account |

|---|---|

| Swap Charges | No |

| Available for | Standard, Fixed, ECN |

| Additional Fees | May apply for long-term positions |

Traders interested in the Islamic account option should contact Amarkets customer support for more details and to set up this account type.

Demo Account Option

Before committing to any of the live Amarkets account types, traders have the option to open a demo account. The demo account allows you to practice trading with virtual funds in real market conditions. This can be an excellent way to:

- Familiarize yourself with the trading platform

- Test different trading strategies without risk

- Understand how different account types work

- Practice risk management techniques

The demo account mimics the conditions of a Standard account but can be customized to reflect other account types if requested.

Try DemoConclusion

Amarkets account types offer a diverse range of options to suit different trading styles, experience levels, and preferences. From the beginner-friendly Standard account to the professional-grade ECN account, and the specialized Crypto account, there's an option for every type of trader.

When choosing among the Amarkets account types, consider your trading experience, preferred assets, available capital, and risk tolerance. Remember that you can always start with a demo account to get a feel for the platform and trading conditions before committing to a live account.

Regardless of the account type you choose, Amarkets provides a robust trading environment with access to popular trading platforms, educational resources, and customer support. By understanding the features and benefits of each account type, you can make an informed decision that aligns with your trading goals and strategies.

FAQ

Can I change my Amarkets account type after opening it?

Yes, Amarkets allows you to change your account type after opening. You can usually do this by contacting customer support. However, be aware that there might be minimum deposit requirements or other conditions to meet when switching to a different account type.

What is the difference between floating and fixed spreads in Amarkets account types?

Floating spreads, available in Standard and ECN accounts, can change based on market conditions. They are typically tighter but can widen during volatile market periods. Fixed spreads, offered in the Fixed account, remain constant regardless of market conditions. They provide more predictable trading costs but are usually wider than floating spreads.

Are there any restrictions on the Islamic (Swap-Free) account option?

While the Islamic account option doesn't charge or pay swaps, there may be restrictions or additional fees for holding positions for extended periods. These accounts are intended for traders following Islamic financial principles and may require verification of religious status. It's best to check with Amarkets customer support for specific terms and conditions of Islamic accounts.