Introduction to Amarkets

When it comes to online trading, choosing the right broker is crucial. This article aims to provide comprehensive information about Amarkets, a well-established online trading platform. We'll explore various aspects of the company, including its history, trading offerings, platforms, and unique features that set it apart in the competitive world of online trading.

Founded in 2007, Amarkets has grown to become a significant player in the online trading industry. The company has built a reputation for providing a wide range of trading instruments, competitive conditions, and robust educational resources. Let's delve deeper into what makes Amarkets a popular choice among traders worldwide.

About Amarkets: Company Background

To truly understand a broker, it's important to know its background. Here are some key facts about Amarkets:

- Established: 2007

- Headquarters: Saint Vincent and the Grenadines

- Regulation: Financial Services Authority (FSA) of Saint Vincent and the Grenadines

- Global presence: Serves clients from numerous countries

- Trading volume: Over $33 billion monthly

Over the years, Amarkets has expanded its services and adapted to the changing needs of traders. The company's longevity in the industry speaks to its ability to navigate market changes and maintain customer trust.

Trading Instruments Offered by Amarkets

One of the strengths of Amarkets is the wide variety of trading instruments available. This diversity allows traders to explore different markets and potentially diversify their portfolios. Here's an overview of the main instrument categories:

| Instrument Category | Number of Instruments | Spreads From |

|---|---|---|

| Forex | 50+ currency pairs | 0.1 pips |

| Cryptocurrencies | 20+ crypto pairs | 1% of asset value |

| Stocks | 100+ global stocks | 0.1% of asset value |

| Indices | 11 major indices | 0.1 point |

| Commodities | 5+ commodities | 0.01 point |

This diverse range of instruments allows traders to access multiple markets from a single platform, catering to various trading strategies and preferences.

Trading Platforms

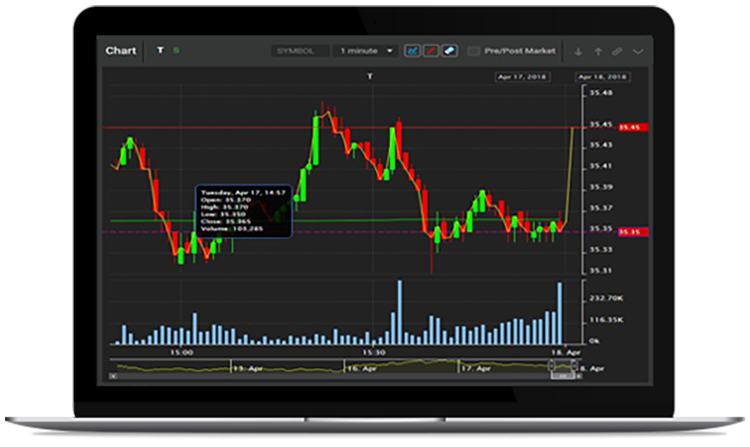

When learning about Amarkets, it's crucial to understand the trading platforms they offer. Amarkets provides access to some of the most popular and robust trading platforms in the industry:

- MetaTrader 4 (MT4): A widely-used platform known for its user-friendly interface and advanced charting tools.

- MetaTrader 5 (MT5): The newer version of MT4, offering additional features and asset classes.

- AMarkets App: A proprietary mobile trading application for on-the-go trading.

These platforms are available on various devices, including desktop computers, web browsers, and mobile devices, ensuring that traders can access their accounts and manage their positions from anywhere at any time.

Account Types

Amarkets offers several account types to cater to different trading styles and experience levels. Here's an overview of the main account types:

| Account Type | Minimum Deposit | Spread Type | Commission |

|---|---|---|---|

| Standard | $100 | Floating from 1.3 pips | No |

| Fixed | $100 | Fixed from 3 pips | No |

| ECN | $200 | Floating from 0 pips | $5 per lot |

| Crypto | 0.001 BTC | Floating | No |

Each account type is designed to meet specific trading needs, from beginners looking for straightforward conditions to advanced traders seeking tight spreads and fast execution.

Educational Resources and Analysis

An important aspect to consider when learning about Amarkets is the educational support provided. Amarkets offers a range of educational resources to help traders improve their skills and make informed decisions:

- Video tutorials

- Webinars

- Trading articles and guides

- Economic calendar

- Market analysis

These resources cater to traders of all levels, from beginners learning the basics to experienced traders looking to refine their strategies. The provision of regular market analysis and an economic calendar helps traders stay informed about market-moving events.

Customer Support

Quality customer support is crucial for any online broker. Amarkets provides several channels for customer assistance:

- 24/5 live chat support

- Email support

- Phone support

- Extensive FAQ section

The availability of multi-lingual support staff ensures that traders from various regions can receive assistance in their preferred language.

Unique Features of Amarkets

When discussing about Amarkets, it's worth highlighting some unique features that set the broker apart:

- Copy Trading: Amarkets offers a copy trading feature, allowing less experienced traders to replicate the trades of successful traders.

- VPS Hosting: Traders can access free VPS hosting for automated trading, ensuring consistent execution even if their personal computer is off.

- Loyalty Program: Amarkets rewards active traders with various bonuses and benefits through its loyalty program.

- Cryptocurrency Support: The broker offers a dedicated crypto account, catering to the growing interest in digital assets.

- Negative Balance Protection: This feature ensures that traders cannot lose more than their account balance, providing an extra layer of risk management.

These features contribute to a more comprehensive trading experience and can be particularly appealing to certain types of traders.

Regulatory Compliance and Security

When choosing a broker, security and regulatory compliance are paramount. Here's what you need to know about Amarkets in this regard:

- Regulation: Regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines

- Client Fund Security: Segregated client accounts to protect traders' funds

- Data Protection: Use of SSL encryption for data security

- Risk Management: Offers features like negative balance protection and stop-loss orders

While Amarkets' regulatory status may not be as stringent as some jurisdictions, the company implements various measures to ensure the safety of client funds and data.

Deposit and Withdrawal Options

Amarkets provides a variety of options for funding accounts and withdrawing profits:

| Method | Deposit Time | Withdrawal Time | Fees |

|---|---|---|---|

| Credit/Debit Cards | Instant | 1-3 business days | No fees from Amarkets |

| Bank Transfer | 3-5 business days | 3-7 business days | May incur bank fees |

| E-wallets (Skrill, Neteller) | Instant | Within 24 hours | No fees from Amarkets |

| Cryptocurrencies | After blockchain confirmation | After blockchain confirmation | Network fees may apply |

The variety of payment options and the absence of fees from Amarkets for most methods make funding and withdrawing from accounts relatively convenient for traders.

Conclusion

In conclusion, this comprehensive overview about Amarkets reveals a broker with a solid track record in the online trading industry. With its wide range of trading instruments, diverse account types, and robust trading platforms, Amarkets caters to traders of various experience levels and preferences.

The broker's commitment to education, coupled with features like copy trading and VPS hosting, demonstrates a focus on helping traders develop their skills and implement various strategies. The provision of cryptocurrency trading options also shows Amarkets' adaptability to evolving market trends.

While Amarkets offers many attractive features, potential clients should always conduct their own research and consider their individual trading needs when choosing a broker. Factors such as regulatory status, trading conditions, and personal risk tolerance should all be taken into account.

Ultimately, Amarkets presents itself as a versatile option in the online trading landscape, offering a blend of established trading tools and innovative features to serve a global client base.